You are here:Bean Cup Coffee > markets

Bitcoin Price Spread: Understanding the Dynamics and Implications

Bean Cup Coffee2024-09-21 22:55:50【markets】1people have watched

Introductioncrypto,coin,price,block,usd,today trading view,The cryptocurrency market, particularly Bitcoin, has been a hot topic of discussion among investors airdrop,dex,cex,markets,trade value chart,buy,The cryptocurrency market, particularly Bitcoin, has been a hot topic of discussion among investors

The cryptocurrency market, particularly Bitcoin, has been a hot topic of discussion among investors and enthusiasts. One of the key aspects that attract attention is the Bitcoin price spread. In this article, we will delve into the concept of Bitcoin price spread, its dynamics, and the implications it holds for the market.

What is Bitcoin Price Spread?

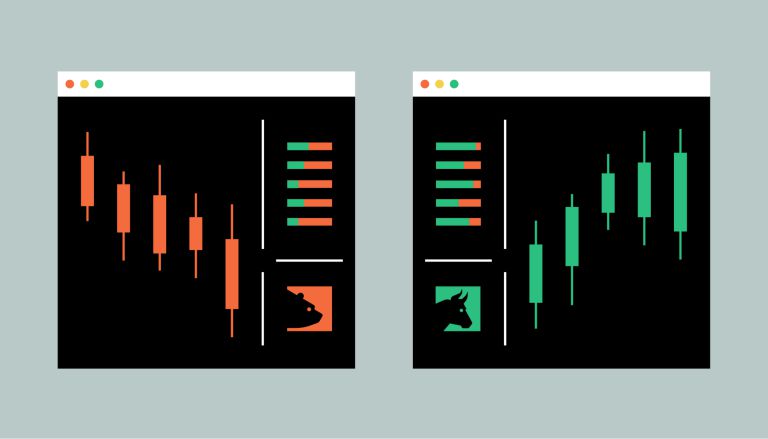

Bitcoin price spread refers to the difference between the highest and lowest prices at which Bitcoin is being traded on different exchanges. It is a measure of the volatility and liquidity in the Bitcoin market. A wider spread indicates higher volatility, while a narrower spread suggests lower volatility and higher liquidity.

Dynamics of Bitcoin Price Spread

1. Market Liquidity: The liquidity of the Bitcoin market plays a crucial role in determining the price spread. Exchanges with higher trading volumes tend to have lower spreads as they attract more buyers and sellers, leading to a more efficient market. Conversely, exchanges with lower trading volumes may experience wider spreads due to limited liquidity.

2. Exchange Differences: Different exchanges may have varying price spreads due to various factors such as trading fees, order book depth, and execution speed. For instance, exchanges with lower trading fees may attract more traders, resulting in a narrower spread. Additionally, exchanges with advanced matching algorithms and faster execution may also contribute to a lower spread.

3. Market Sentiment: Market sentiment can significantly impact the Bitcoin price spread. During periods of high volatility, such as during major news events or regulatory announcements, the spread may widen as traders become more cautious and hesitant to execute trades.

4. Geographical Factors: The geographical location of exchanges can also influence the Bitcoin price spread. Exchanges in regions with stricter regulations or higher transaction costs may experience wider spreads compared to those in more lenient regions.

Implications of Bitcoin Price Spread

1. Trading Opportunities: Understanding the Bitcoin price spread can help traders identify potential trading opportunities. By analyzing the spread, traders can identify exchanges with favorable conditions for arbitrage, where they can buy Bitcoin at a lower price on one exchange and sell it at a higher price on another.

2. Market Confidence: A narrower Bitcoin price spread can indicate higher market confidence and liquidity. This can be beneficial for long-term investors as it suggests a more stable market environment.

3. Exchange Reputation: Exchanges with lower price spreads are often perceived as more reliable and trustworthy. This can attract more traders and contribute to the overall growth of the exchange.

4. Regulatory Implications: The Bitcoin price spread can also have regulatory implications. Authorities may scrutinize exchanges with unusually wide spreads to ensure fair trading practices and prevent market manipulation.

Conclusion

The Bitcoin price spread is a critical factor that reflects the dynamics and volatility of the cryptocurrency market. By understanding the factors influencing the spread and its implications, investors and traders can make more informed decisions. As the market continues to evolve, monitoring the Bitcoin price spread will remain an essential aspect of navigating the cryptocurrency landscape.

This article address:https://www.nutcupcoffee.com/eth/23b60999367.html

Like!(9459)

Related Posts

- Binance NFT Listing: A Game-Changing Move in the Cryptocurrency World

- How to Convert Bitcoin in Cash: A Comprehensive Guide

- Bitcoin Cash Loans: A Game-Changing Financial Solution

- How to Transfer My BNB from Binance to Metamask

- Bitcoin Price Old Price: A Look Back at the Evolution of the Cryptocurrency Market

- Do I Have to Report Taxes on Binance Trades?

- How Do I Send Money from Binance to Coinbase?

- Unlocking the Power of Binance App with API Key: A Comprehensive Guide

- How to Stop Loss on the Binance App: A Comprehensive Guide

- Bitcoin Chart Price 2010: A Journey Through the Early Days of Cryptocurrency

Popular

Recent

Should I Buy Bitcoin Cash Now or Wait?

Create a Bitcoin Mining Website: A Comprehensive Guide

Bitcoin Wallet Size 2017: A Look Back at the Evolution of Cryptocurrency Storage

Bitcoin Mining Motherboard Setup: A Comprehensive Guide

Mining Bitcoin with Excel: A Surprising Approach to Cryptocurrency Extraction

**Unlocking the Power of Bitcoin Mining with Termux: A Comprehensive Guide

Bitcoin Cash Roulette Live: The Thrilling New Casino Game That's Taking the World by Storm

Do I Have to Report Taxes on Binance Trades?

links

- Coinbase vs Binance vs Gemini: A Comprehensive Comparison

- Bitcoin Wallet and Keys: The Cornerstones of Cryptocurrency Security

- How to Trade Bitcoin Cash App: A Comprehensive Guide

- Can US Citizens Buy Bitcoin from Coingate?

- How to Buy BNB Outside of Binance: Exploring Alternative Options

- Bitcoin Cash Coin Dance: A Vibrant Community Celebrating Cryptocurrency's Rise

- How Do I Move Bitcoin from Coinbase to Binance?

- How to Purchase Bitcoin Cash on Reddit: A Comprehensive Guide

- Binance Coin vs Coinbase: A Comprehensive Comparison

- Vietnam Bitcoin Mining: A Booming Industry in Southeast Asia